Understanding SEO Specialist Salaries in the UK

The Average SEO Specialist Salary in the UK

Search Engine Optimization (SEO) has become a crucial aspect of digital marketing strategies for businesses in the UK. As a result, the demand for skilled SEO specialists has been on the rise, leading to competitive salaries in this field.

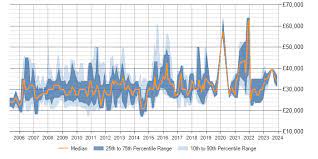

According to recent data, the average salary for an SEO specialist in the UK is around £30,000 to £40,000 per year. However, this figure can vary based on factors such as experience, location, and the size of the company.

In London, where many digital marketing agencies and tech companies are based, SEO specialists tend to earn higher salaries compared to other regions in the UK. Senior SEO specialists with several years of experience can command salaries upwards of £50,000 or more.

Entry-level positions for SEO specialists typically start at around £20,000 to £25,000 per year. As professionals gain more experience and expertise in areas such as keyword research, on-page optimization, and link building, their earning potential increases.

It’s important to note that salary ranges can also be influenced by additional skills such as proficiency in Google Analytics, content marketing, and social media management. Continuous learning and staying updated with industry trends can further enhance an SEO specialist’s earning potential.

In conclusion, the field of SEO offers promising career opportunities with competitive salaries in the UK. As businesses continue to invest in online visibility and digital marketing efforts, skilled SEO specialists play a vital role in driving organic traffic and improving search engine rankings.

Understanding SEO Specialist Salaries in the UK: 17 Key Questions Answered

- How much do SEO jobs pay in the UK?

- How much do SEO jobs pay in London?

- Is SEO a high paying job?

- How much can you make as an SEO Specialist?

- How much do SEO consultants make UK?

- How do I become a SEO expert UK?

- How much does an SEO developer earn UK?

- What does a SEO specialist do?

- How much does a SEO Specialist make?

- Is SEO specialist a stressful job?

- How much an SEO expert can earn?

- How much do SEO specialists earn?

- Is SEO Specialist a good job?

- How much money does an SEO expert make?

- How much do SEO specialists make per hour UK?

- What is the salary of SEO with 5 years experience?

- Is SEO a well paid job?

How much do SEO jobs pay in the UK?

In the UK, SEO job salaries can vary depending on factors such as experience level, location, and the specific responsibilities of the role. On average, SEO jobs in the UK typically pay between £30,000 to £40,000 per year. Entry-level positions may start at around £20,000 to £25,000 annually, while senior SEO specialists with extensive experience can earn upwards of £50,000 or more, especially in major cities like London. Additional skills and expertise in areas such as content marketing and analytics can also impact salary ranges for SEO professionals in the UK.

How much do SEO jobs pay in London?

In London, SEO jobs typically offer competitive salaries that reflect the city’s status as a hub for digital marketing and tech industries. The average pay for SEO specialists in London ranges from around £30,000 to £50,000 per year, depending on factors such as experience level, specific skills, and the employer’s size and industry focus. Entry-level positions may start at approximately £20,000 to £25,000 annually, while senior SEO specialists with advanced expertise can earn upwards of £50,000 or more. With London being a dynamic market for digital talent, SEO professionals with a strong track record in areas like keyword research, technical optimization, and content strategy are well-positioned to command competitive salaries in this vibrant city.

Is SEO a high paying job?

In the UK, SEO can indeed be a high-paying job for skilled professionals. As businesses increasingly focus on their online presence and digital marketing strategies, the demand for SEO specialists has grown significantly. With the ability to drive organic traffic, improve search engine rankings, and enhance online visibility, experienced SEO specialists are valued assets in the competitive digital landscape. Salaries for SEO professionals in the UK can range from entry-level positions starting at around £20,000 to senior roles commanding upwards of £50,000 or more, depending on factors such as expertise, experience, and location. Continuous learning and staying abreast of industry trends can further elevate an SEO specialist’s earning potential in this dynamic field.

How much can you make as an SEO Specialist?

When considering the earning potential as an SEO Specialist in the UK, it is important to take into account various factors that can influence salary ranges. On average, SEO specialists in the UK can expect to earn between £30,000 to £40,000 per year, with opportunities for higher salaries based on experience, location, and the size of the company. Entry-level positions typically start at around £20,000 to £25,000 annually, while senior SEO specialists with advanced skills and expertise may command salaries exceeding £50,000. Continuous learning and staying abreast of industry trends can further enhance an SEO specialist’s earning potential in this dynamic and competitive field.

How much do SEO consultants make UK?

In the UK, SEO consultants’ earnings can vary depending on factors such as experience, expertise, and the scope of their projects. On average, SEO consultants in the UK can make anywhere from £25,000 to £50,000 per year. However, seasoned professionals with a strong track record of delivering successful SEO campaigns may command higher salaries exceeding £60,000 annually. The specific industry sector and location can also influence an SEO consultant’s earning potential. Overall, the demand for skilled SEO consultants continues to grow in the UK as businesses increasingly recognise the importance of search engine optimisation in enhancing their online presence and visibility.

How do I become a SEO expert UK?

To become an SEO expert in the UK, individuals typically start by gaining a solid understanding of search engine optimization principles through self-study or formal education. It is essential to stay updated on the latest trends and algorithms used by search engines like Google. Practical experience through internships or entry-level positions in digital marketing agencies can provide valuable hands-on training. Developing a strong skill set in keyword research, content optimization, technical SEO, and link building is crucial. Continuous learning, networking with industry professionals, and obtaining relevant certifications can also help aspiring SEO experts establish themselves in the field and advance their careers in the competitive UK market.

How much does an SEO developer earn UK?

In the UK, the salary of an SEO developer can vary depending on factors such as experience, location, and the specific responsibilities of the role. On average, an SEO developer in the UK can expect to earn between £25,000 to £35,000 per year. However, experienced SEO developers with a strong track record of improving website performance and search engine rankings may command higher salaries, ranging from £40,000 to £50,000 or more. It’s worth noting that continuous learning and staying abreast of the latest SEO techniques and algorithms can contribute to an SEO developer’s earning potential in the competitive digital marketing landscape of the UK.

What does a SEO specialist do?

A Search Engine Optimization (SEO) specialist plays a crucial role in enhancing a website’s visibility and ranking on search engine results pages. Their primary focus is to implement strategies that improve organic traffic by optimising website content, conducting keyword research, and building quality backlinks. SEO specialists also analyse website performance metrics, monitor search engine algorithms, and make data-driven decisions to improve search engine rankings. By staying updated with industry trends and best practices, SEO specialists help businesses attract more relevant visitors to their websites and increase online presence.

How much does a SEO Specialist make?

When considering the salary of an SEO Specialist in the UK, it is important to note that the average annual income typically falls within the range of £30,000 to £40,000. However, this figure can vary based on factors such as the individual’s level of experience, geographical location, and the size of the employing company. In high-demand areas like London, where digital marketing agencies are prevalent, SEO specialists may command higher salaries, especially those with senior-level expertise earning upwards of £50,000 or more annually. Entry-level positions for SEO specialists usually start at around £20,000 to £25,000 per year and can increase as professionals gain more experience and skills in areas such as keyword research and content optimization.

Is SEO specialist a stressful job?

Navigating the world of Search Engine Optimization (SEO) as a specialist in the UK can indeed be a challenging and sometimes stressful endeavour. The role often involves staying abreast of ever-evolving search engine algorithms, conducting detailed keyword research, analysing data metrics, and implementing strategies to improve website rankings. Deadlines, client expectations, and the dynamic nature of the digital landscape can contribute to the pressure felt by SEO specialists. However, for individuals who thrive in fast-paced environments, enjoy problem-solving, and have a passion for driving online visibility, the challenges of the job can also be rewarding and fulfilling. Balancing technical expertise with creativity and adaptability is key to managing the stress associated with being an SEO specialist in the UK.

How much an SEO expert can earn?

When considering the earning potential of an SEO expert in the UK, it’s important to note that salaries can vary based on several factors. On average, an experienced SEO expert can earn anywhere from £30,000 to £50,000 per year. However, top-tier professionals with a proven track record and specialised skills may command even higher salaries. Factors such as location, industry demand, and additional expertise in areas like technical SEO or content marketing can also influence an SEO expert’s earning capacity. Continuous learning and staying abreast of the latest trends in search engine optimisation can further enhance an individual’s earning potential in this dynamic field.

How much do SEO specialists earn?

One of the most common questions regarding SEO specialist salaries in the UK is, “How much do SEO specialists earn?” SEO specialists in the UK typically earn an average salary ranging from £30,000 to £40,000 per year. However, this figure can vary based on factors such as experience level, location, and company size. In regions like London, where the digital marketing industry is thriving, SEO specialists may command higher salaries, especially for senior positions with extensive expertise in areas such as keyword research and link building. Entry-level roles usually start at around £20,000 to £25,000 per year, with opportunities for salary growth as professionals gain more experience and develop additional skills in areas like content marketing and data analysis.

Is SEO Specialist a good job?

The role of an SEO specialist in the UK is often considered a rewarding career choice for individuals interested in digital marketing and online visibility. With the increasing importance of search engine optimization in driving website traffic and improving online presence, SEO specialists play a crucial role in helping businesses reach their target audience effectively. This job offers opportunities for continuous learning, creativity in implementing SEO strategies, and the satisfaction of seeing tangible results through improved search engine rankings. While the salary range for SEO specialists can vary based on factors such as experience and location, many professionals find this role fulfilling due to its dynamic nature and impact on a company’s online success.

How much money does an SEO expert make?

When considering the salary of an SEO expert in the UK, it is important to note that the average earnings typically range between £30,000 to £40,000 per year. However, factors such as years of experience, specific skill set, and the geographical location can influence the actual income. Entry-level SEO experts may start at around £20,000 to £25,000 annually, with potential for significant growth as they gain expertise in areas like keyword research and on-page optimization. Seasoned professionals with advanced skills and a proven track record can command salaries exceeding £50,000, particularly in regions such as London where demand for digital marketing talent is high.

How much do SEO specialists make per hour UK?

When it comes to determining the hourly rate for SEO specialists in the UK, several factors come into play. On average, SEO specialists in the UK can earn between £15 to £50 per hour, depending on their level of expertise, experience, and the specific requirements of the role. Entry-level SEO specialists may start at a lower hourly rate, while senior professionals with a proven track record and advanced skills command higher rates. It’s essential for businesses and individuals seeking SEO services to consider the value that experienced specialists bring to improving online visibility and driving organic traffic when discussing hourly rates.

What is the salary of SEO with 5 years experience?

One common query regarding SEO specialist salaries in the UK is about the earning potential of professionals with 5 years of experience in the field. Typically, an SEO specialist with 5 years of solid experience can expect to command a higher salary compared to entry-level or junior positions. In the UK, a seasoned SEO specialist with 5 years under their belt could potentially earn between £40,000 to £50,000 per year, depending on factors such as expertise, industry knowledge, and the specific responsibilities they undertake within their role. This level of experience often correlates with a deeper understanding of SEO strategies and a proven track record of delivering successful outcomes for businesses through organic search tactics.

Is SEO a well paid job?

In the UK, SEO is considered a well-paid job, with salaries for SEO specialists ranging from around £30,000 to £40,000 per year on average. The demand for skilled SEO professionals has increased significantly as businesses place greater emphasis on digital marketing and online visibility. In London, where many digital marketing agencies are located, SEO specialists can command higher salaries, especially for those with senior-level experience. While entry-level positions may start at lower salaries, opportunities for career growth and higher earnings exist as professionals gain expertise in various aspects of SEO such as keyword research, on-page optimization, and link building. Continuous learning and staying abreast of industry trends can further enhance the earning potential of individuals in the field of SEO in the UK.